Now almost everyone has two-wheelers to suffice their regular transportation needs in daily life. The market has plenty of bike models that come in diverse price ranges. However, no matter whether your bike belongs to the high-end or moderate price range, each vehicle must be well insured with a bike insurance program. This is a very useful financial compensation program that offers you adequate monetary support in case your vehicle meets an accident or goes through damage.

What is Third Party Bike Insurance?

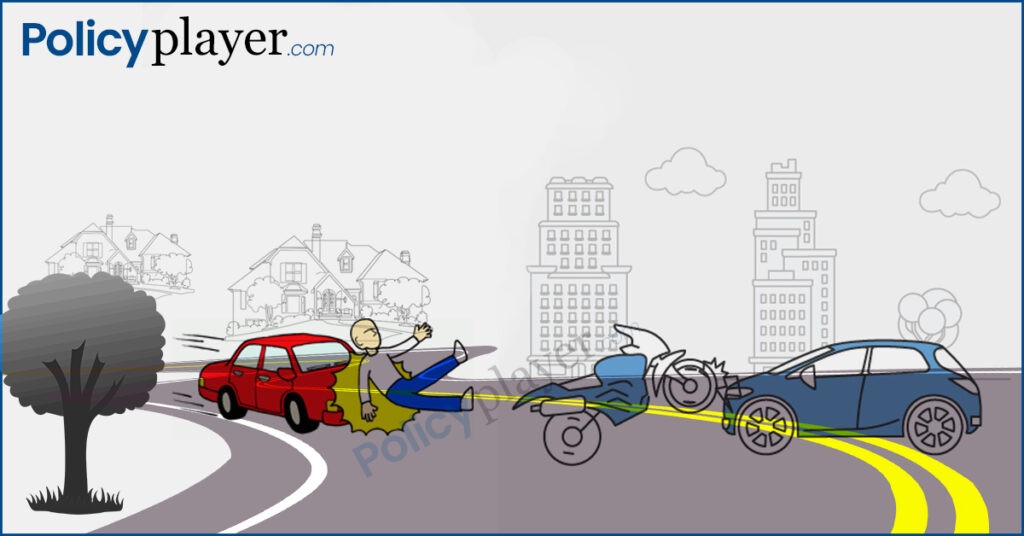

Third-Party bike insurance is the most fundamental type of two-wheeler coverage plan, that supports cover for any injuries and losses your vehicle could cause to a third-party character, property or vehicle. It is effective especially in the event of an accident or collision. The equivalent is compulsory by law, without which you could be responsible for a penalty of Rs 1,000 to Rs 2,000.

You can easily buy third party bike insurance online to avoid such circumstances. Here are some coverage benefits-

- Personal Loss to Third Party: If a person is hurt in an accident by your bike, all his or her medical expenses till restoration will be paid by Third Party bike insurance. In an ill-fated case of death, a settlement amount is provided as well.

- Property Injury Allowance: In fact, if the damage is caused to someone’s vehicle, house or any other asset, the owner will be embraced for the damage.

- Personal Harm to Owner/Driver: This plan cover also protects you from losses that could occur if you face any visible damages or death/lasting disability.

Considerations To Make While Claiming Third-Party Bike Insurance

If you are insured under Third Party Bike Insurance, and you are in need to claim that benefit, make sure you do not hurry. There are certain things that you should consider. For example: make sure the third-party person has suitable evidence against the FIR he/she is filing against you. Again, also note that you have to claim the insurance soon after the accident has occurred, otherwise it won’t come into effect. Again, the IRDAI regulations speculate that only Motor Accident Claims Tribunal can determine the claim amount and the limited liability is only up to Rs 7.5 lakhs.